Kings County Appraisal District New York

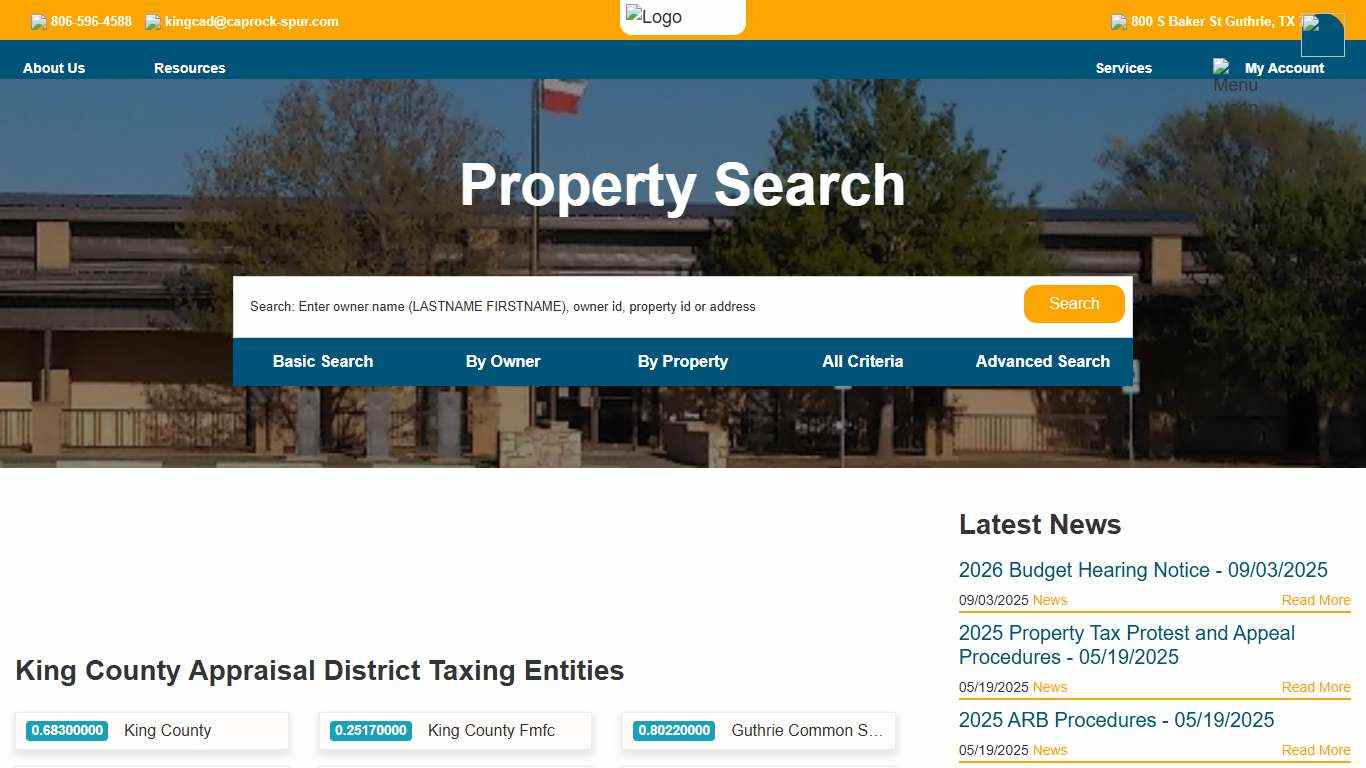

King County Appraisal District

The King County Appraisal District appraises property for ad valorem taxation of these taxing authorities. King County Guthrie Common School District Crowell ISD Gateway GCD The duties of the appraisal district include: - The determination of market value of taxable property - The administration of exemptions and special valuations authorized by the local entities and the State of Texas Tax rates and ultimately the amount of taxes levied on pr...

https://www.kingcad.org/

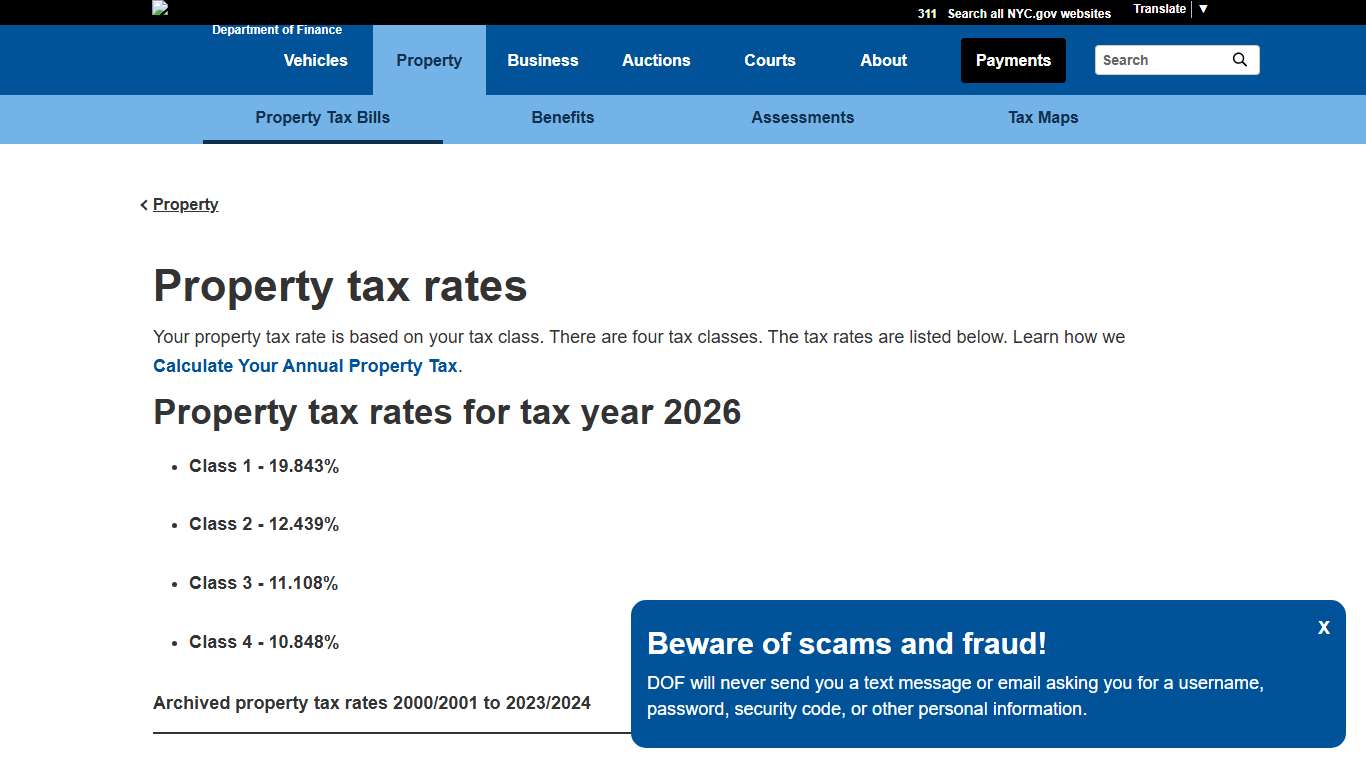

Property Tax Rates

PropertyProperty tax rates Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how we Calculate Your Annual Property Tax. Property tax rates for tax year 2026 - Class 1 - 19.843% - Class 2 - 12.439% - Class 3 - 11.108% - Class 4 - 10.848% School tax rates for tax years 1981-2018 Historically, school tax rates...

https://www.nyc.gov/site/finance/property/property-tax-rates.page

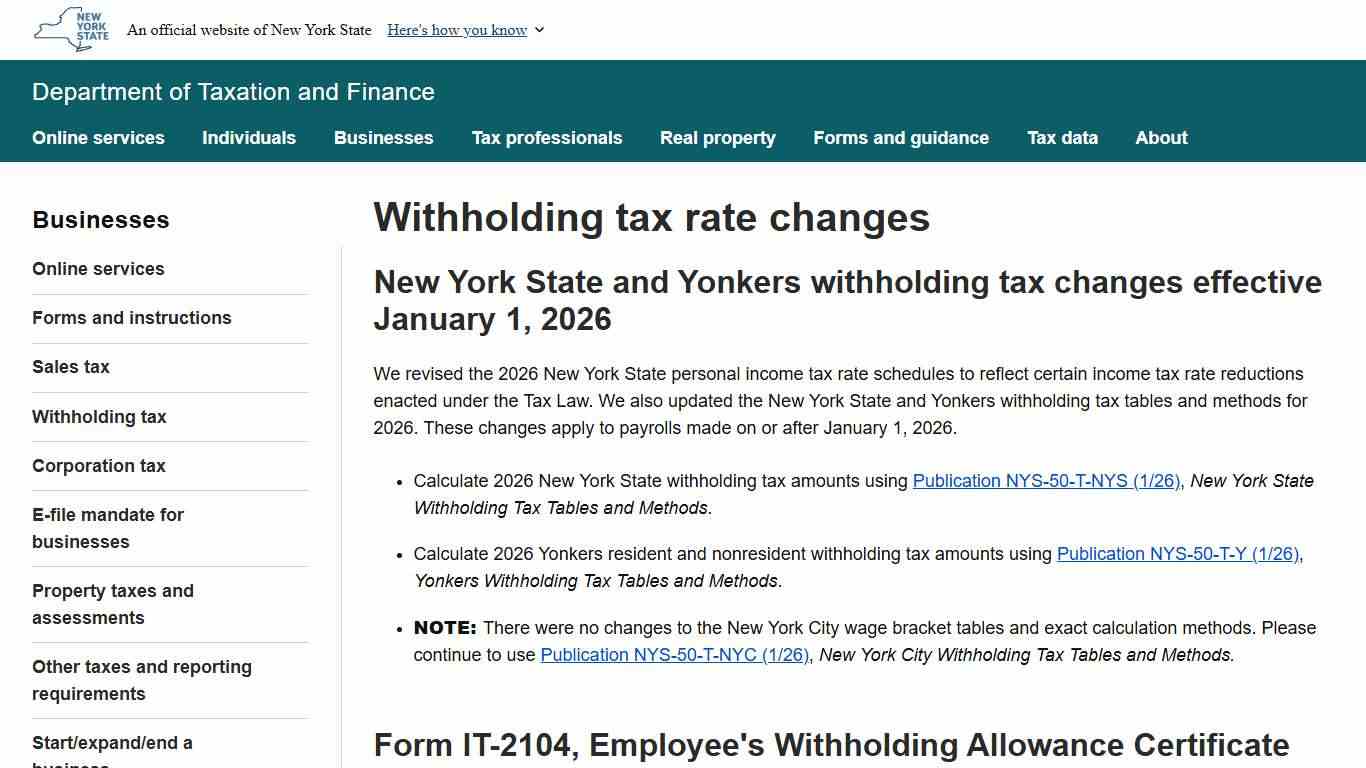

Withholding tax rate changes

Withholding tax rate changes New York State and Yonkers withholding tax changes effective January 1, 2026 We revised the 2026 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers withholding tax tables and methods for 2026.

https://www.tax.ny.gov/bus/wt/rate.htm

Page Not Found

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset’s services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gath...

https://smartasset.com/taxes/new-york-property-tax-calculator

Kings County Public Records - NETR Online

... Kings Records, Kings Property Tax, New York Property Search, New York Assessor. ... This data is not to be construed as legal advice. 1999- 2026 ...

https://publicrecords.netronline.com/state/NY/county/kingsOverall, 2026 is shaping up as a more balanced market in Kings County compared to the frenzy of past years. What we’re seeing: • Buyer demand is steady, especially for well-priced, move-in-ready homes • Interest rates stabilizing = more confidence, fewer panic decisions • Inventory is slowly increasing, giving buyers options—but good homes still move • Pricing strategy matters more than ever; overpricing = longer days on market Big takeaway...

https://www.instagram.com/reel/DTcQXt3CoBD/

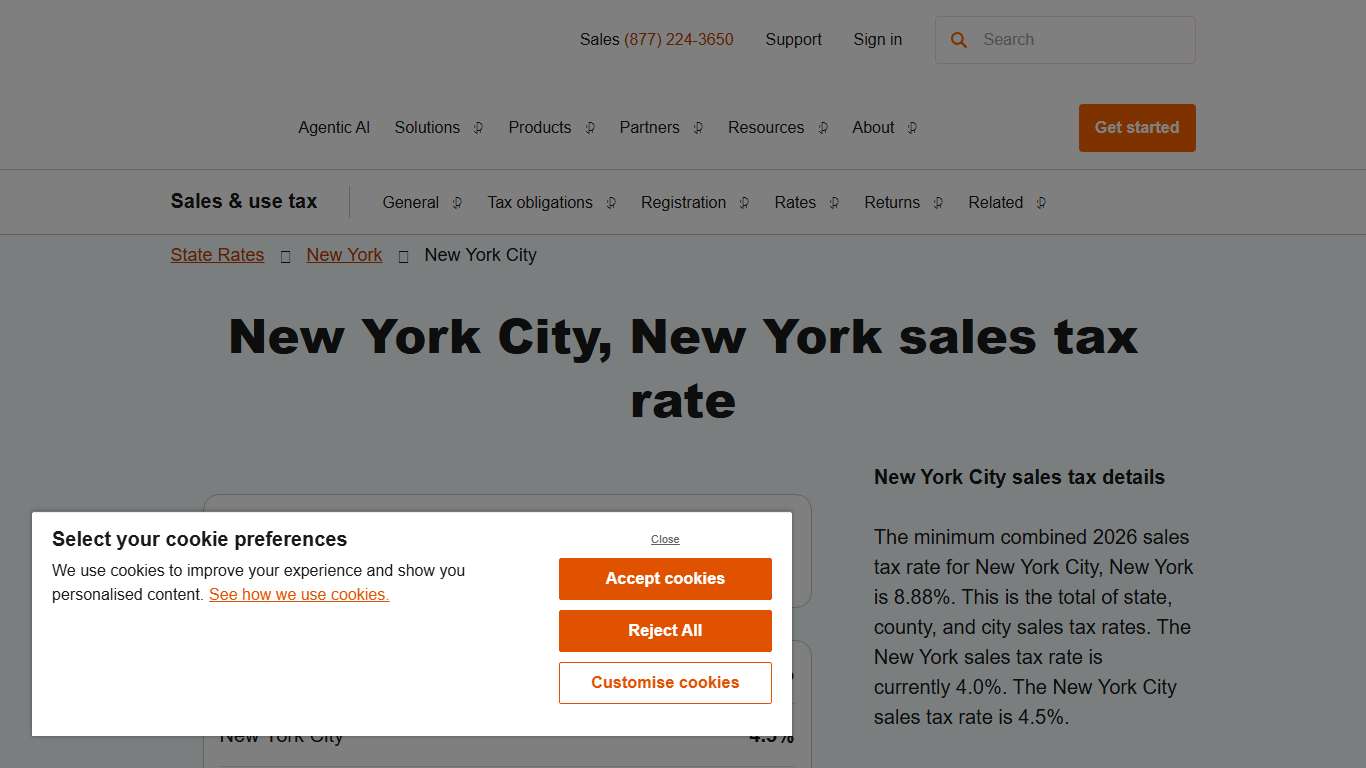

2026 Brooklyn, New York Sales Tax Calculator & Rate – Avalara

New York City sales tax details The minimum combined 2026 sales tax rate for New York City, New York is 8.88%. This is the total of state, county, and city sales tax rates. The New York sales tax rate is currently 4.0%. The New York City sales tax rate is 4.5%.

https://www.avalara.com/taxrates/en/state-rates/new-york/cities/brooklyn.html

Property Taxes

Beginning January 1st, 2026: All debit and credit card payments are subject to a 2.35% service fee, with a minimum fee of $2.00. The service fee is charged by our payment processor. King County does not receive any part of the service fee.

https://payment.kingcounty.gov/Home/Index?app=PropertyTaxes

Kings County, New York Property Taxes - Ownwell

Kings County, New York Property Taxes Median Kings County effective property tax rate: 0.67%, significantly lower than the national median of 1.02%. Median Kings County home value: $1,094,000 Median annual Kings County tax bill: $6,747, $4,347 higher than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/new-york/kings-county

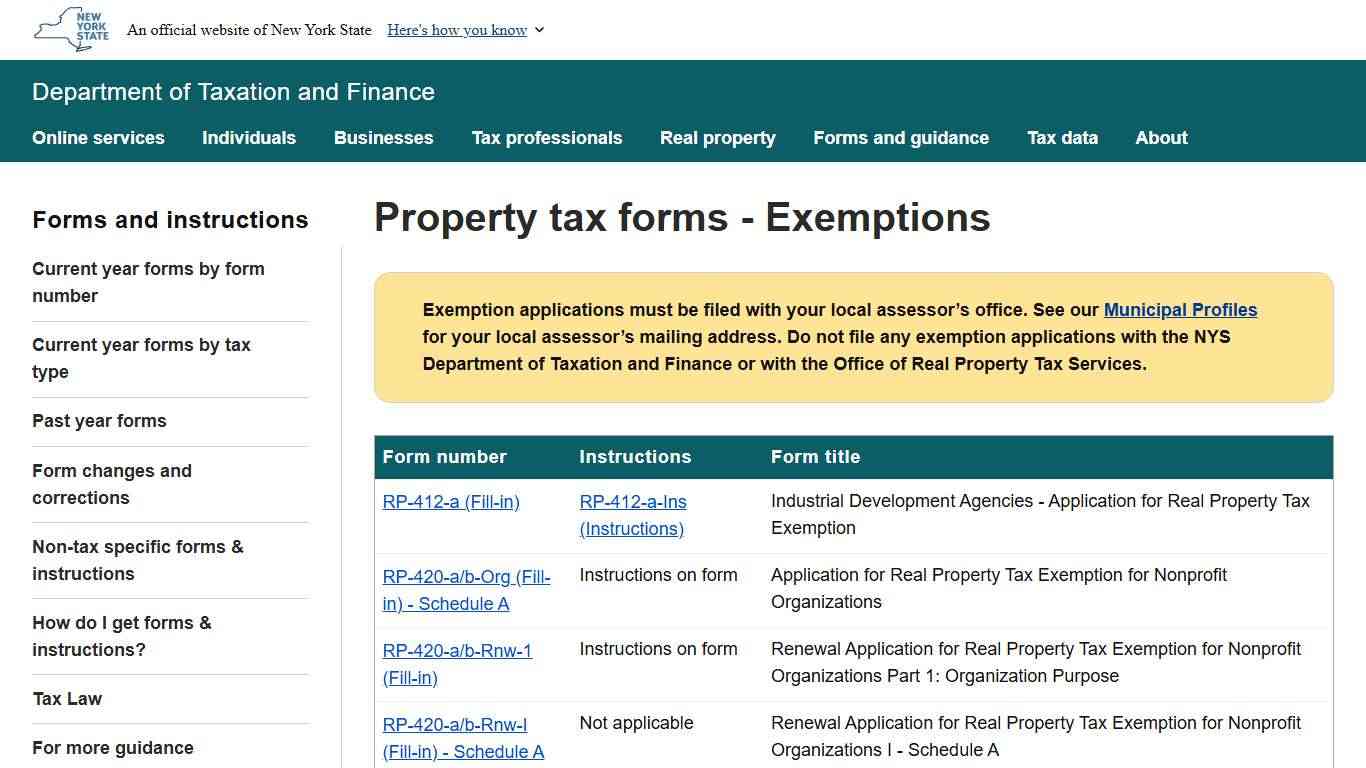

Property tax forms - Exemptions

Application for Conservation Easement Agreement Exemption: Certain Towns (Guilderland and Danby)...

https://www.tax.ny.gov/forms/orpts/exemption.htm

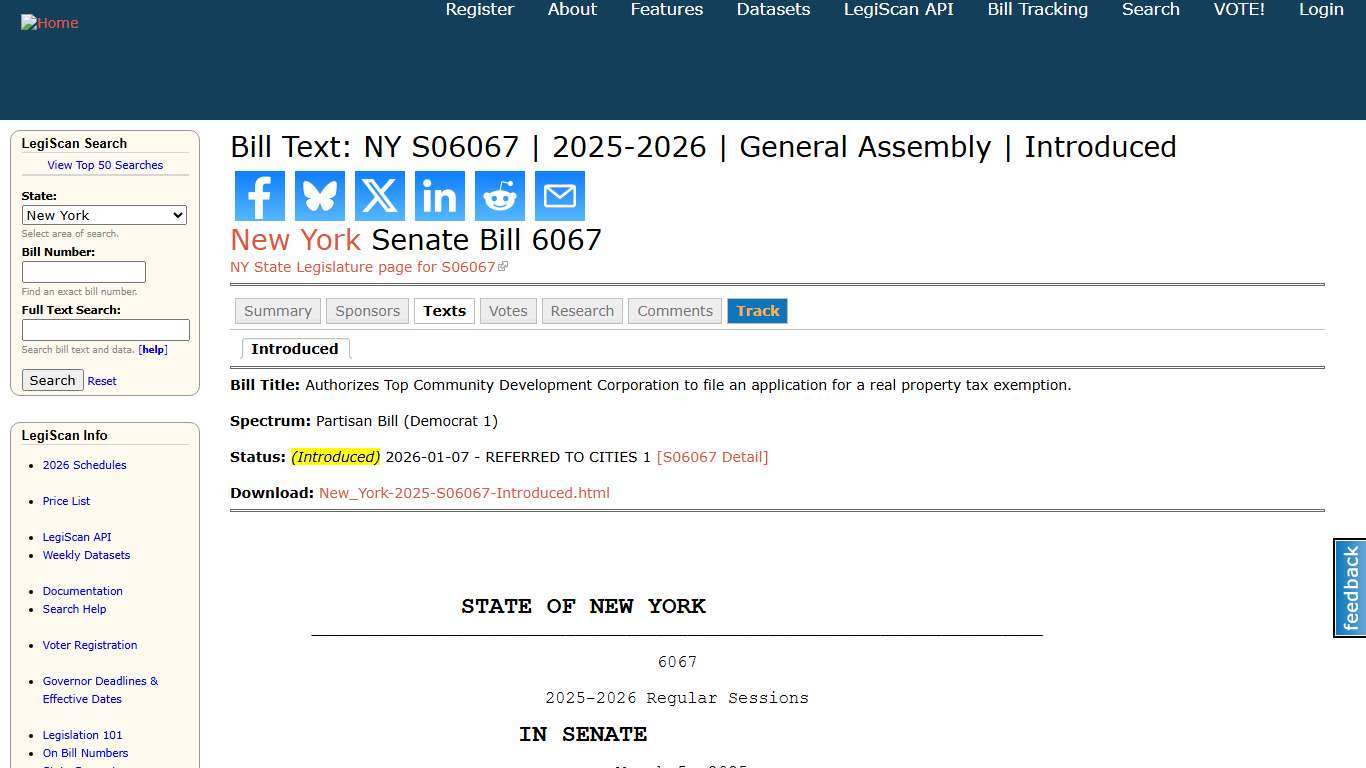

Bill Text: NY S06067 2025-2026 General Assembly Introduced LegiScan

Bill Text: NY S06067 | 2025-2026 | General Assembly | Introduced Bill Title: Authorizes Top Community Development Corporation to file an application for a real property tax exemption. Spectrum: Partisan Bill (Democrat 1) Status: (Introduced) 2026-01-07 - REFERRED TO CITIES 1 [S06067 Detail] Download: New_York-2025-S06067-Introduced.html STATE OF NEW YORK ________________________________________________________________________ 6067 2025-2026 Re...

https://legiscan.com/NY/text/S06067/id/3153866

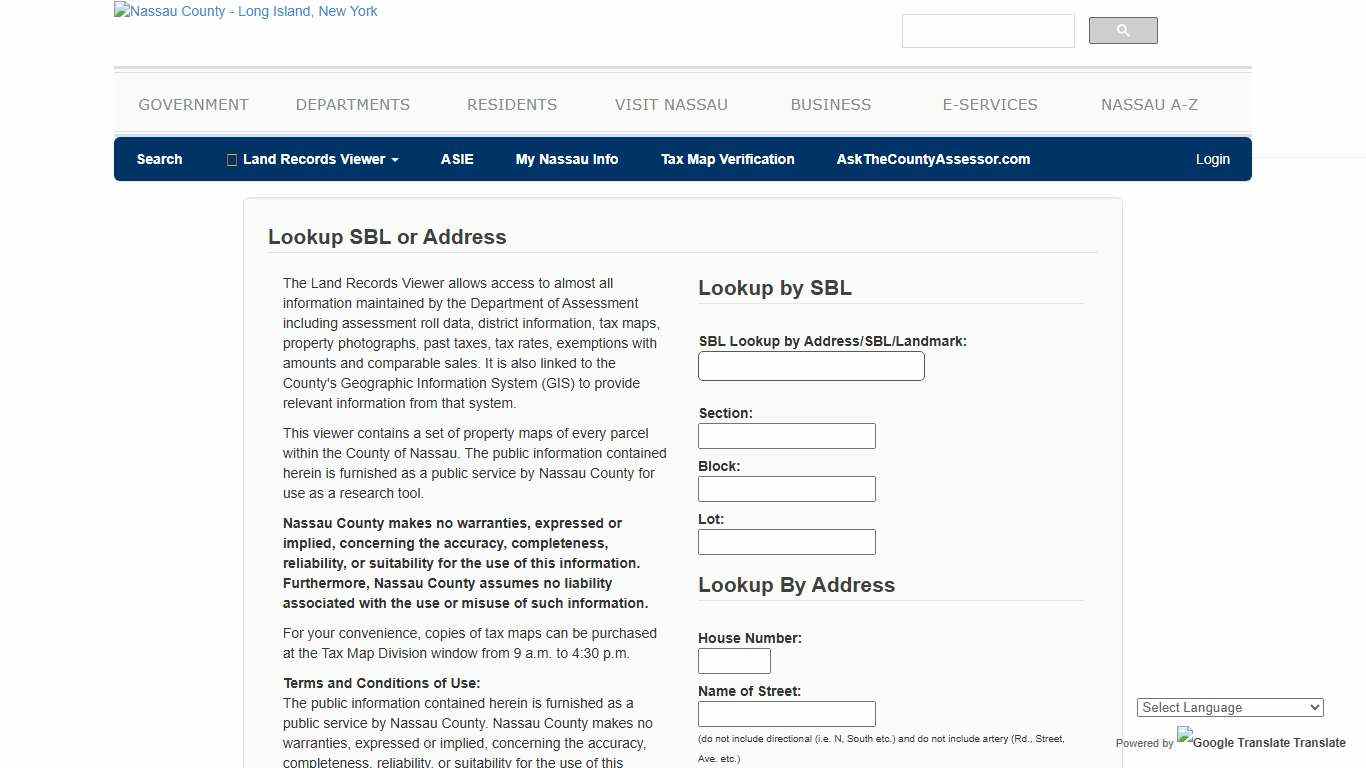

LandRecord Lookup

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data, district information, tax maps, property photographs, past taxes, tax rates, exemptions with amounts and comparable sales. It is also linked to the County's Geographic Information System (GIS) to provide relevant information from that system.

https://lrv.nassaucountyny.gov/

Welcome to the City of Kingston, NY - Assessor's Office

The Snow Emergency ended on Tuesday, January 27 at 7:00pm.

https://kingston-ny.gov/Assessor

Assessor's Office Smithtown, NY - Official Website

Assessor's Office Responsibilities of the Office My staff and I welcome you. Our office is available to assist you in any way possible with the assessment policies and procedures governed by the New York State Real Property Tax Law. Our department is responsible for determining and maintaining assessments, property inventory records, and identifying ownership interest on approximately 43,000 parcels so that the property tax burden is equitably...

https://www.smithtownny.gov/103/Assessors-Office

Kings County probate (Comprehensive Guide 2026) Morgan Legal Group PC

Understanding the Probate Process in Kings County, NY Kings County, more commonly known as Brooklyn, is home to a diverse population, each with unique estate planning needs. Navigating the probate process here can be complex and daunting. At Morgan Legal Group, we specialize in guiding families through this intricate procedure with ease and confidence.

https://www.morganlegalny.com/kings-county-probate-comprehensive-guide-2026/

Comments on New York City’s Fiscal Year 2026 Adopted Budget - Office of the New York City Comptroller Mark Levine

Just days after the City’s FY 2026 budget was adopted, President Trump signed into law the Federal budget reconciliation bill, legislation that will have significant adverse consequences for the New York City economy, the State and City budgets, as well as for health care, food assistance and other benefits provided to New Yorkers.

https://comptroller.nyc.gov/reports/comments-on-new-york-citys-fiscal-year-2026-adopted-budget/

Market Hotness: Median Listing Price in Kings County, NY - 2026 Data 2027 Forecast

Market Hotness: Median Listing Price in Kings County, NY was -3.39457 % Chg. from Yr. Ago in December of 2025, according to the United States Federal Reserve. Historically, Market Hotness: Median Listing Price in Kings County, NY reached a record high of 20.61657 in September of 2017 and a record low of -14.97800 in December of 2021.

https://tradingeconomics.com/united-states/market-hotness-median-listing-price-in-kings-county-ny-percent-change-from-year-ago-fed-data.html

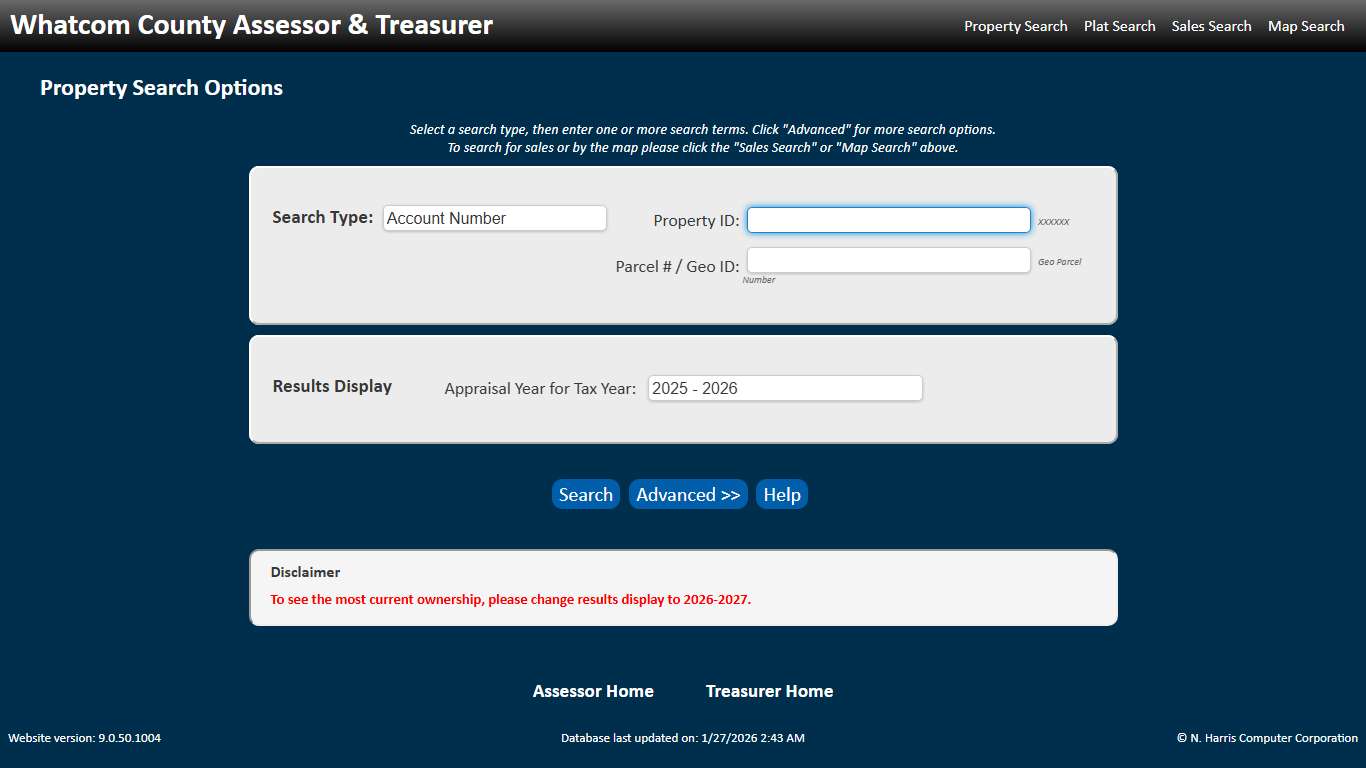

Whatcom County Assessor & Treasurer - Property Search

Property Search Options Select a search type, then enter one or more search terms. Click "Advanced" for more search options. To search for sales or by the map please click the "Sales Search" or "Map Search" above.

https://property.whatcomcounty.us/propertyaccess/?cid=0